Improving self serve rate for business loans

Designed an intuitive & delightful onboarding experience to help users upload their bank statements and provide necessary corrections to get a loan offer quickly.

About Razorpay Capital

Razorpay capital offers credit products to its users such as Line of credit, corporate credit card & Loans.

To avail credit, users must fill in an online application and share the necessary documents.

Overview

We noticed that the bank statement upload process had a significant drop-off rate of ~51%. It became crucial to investigate the issue as it directly contributed to the goal of increasing the overall lending book size by increasing the average ticket size. This project is comprised of 3 smaller projects/objectives we took up to improve the overall onboarding experience for the users.

Imapact

My Role

Owned the entire solutioning aspects from drafting concept notes & conducting user research to designing the flows, interactions & animations.

Team

1x Product designer

1x Product Manager

2x FE engineers

2x BE engineers

Problem Statement

The current credit application journey suffers from high friction and low transparency, leading to a 51% drop-off in instant approvals and a heavy reliance on manual sales intervention. Because bank statement validation occurs too late in the funnel, users are left in a "black box" for days, missing opportunities to optimize their credit limits by providing better financial data.

#1 Delayed Validation

Bank statements are parsed post-submission rather than at the point of upload, turning minor technical errors into multi-day manual support tickets.

#2 The "Black Box" Experience

Users receive no real-time feedback on their application status, leading to a "robotic" journey that lacks the delight and speed expected from a fintech leader.

#3 Sub-optimal Credit Offers

Applicants often upload secondary accounts (Savings/CC) unaware that primary Current Accounts could significantly increase their approval rates and ticket sizes.

#4 Scalability Bottleneck

With over half of all applications requiring manual outreach due to parsing failures, the system is unable to scale alongside Razorpay’s growth.

The process

Defining the user journey

For a complex flow like loan onboarding which is heavily dependent on the back-end, it was essential to map out all possibilities and scenario handling before we moved ahead with designing the screens.

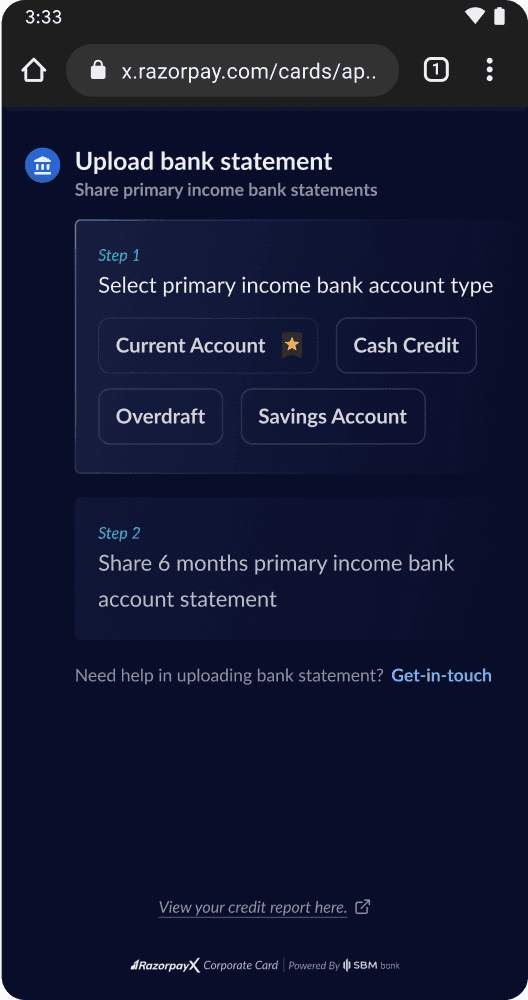

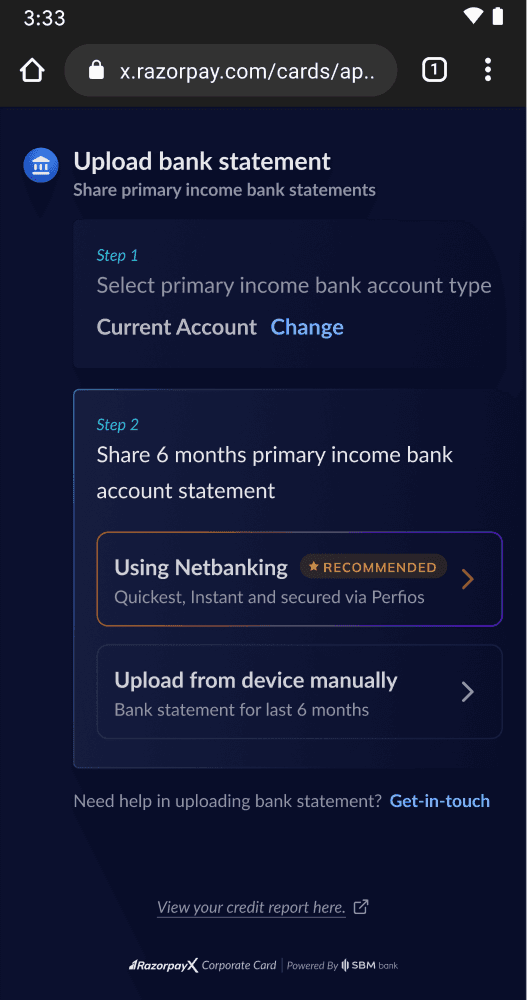

#1 Simplifying the bank statement screens

The first part aims at creating a simple and straight forward bank statement collection experience for the users. This involved redesigning the screen as well as the copy.

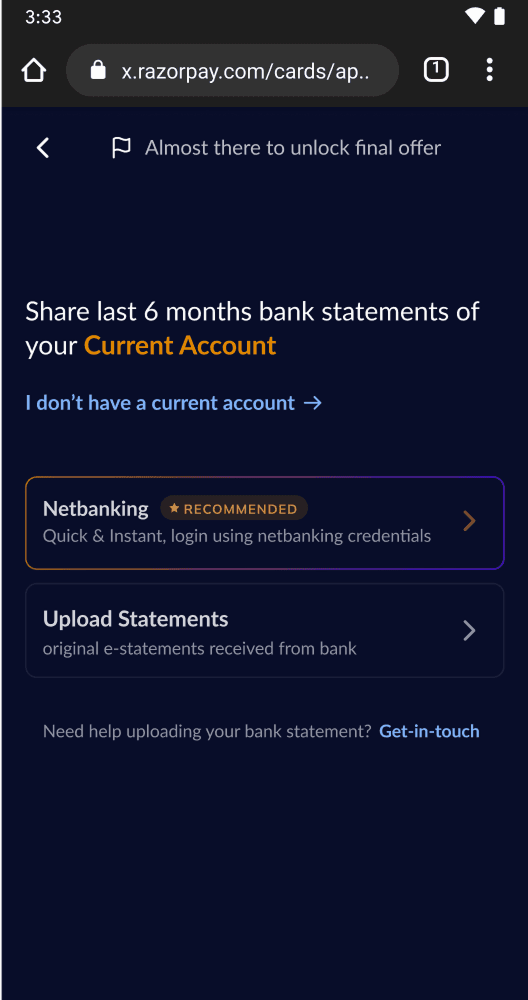

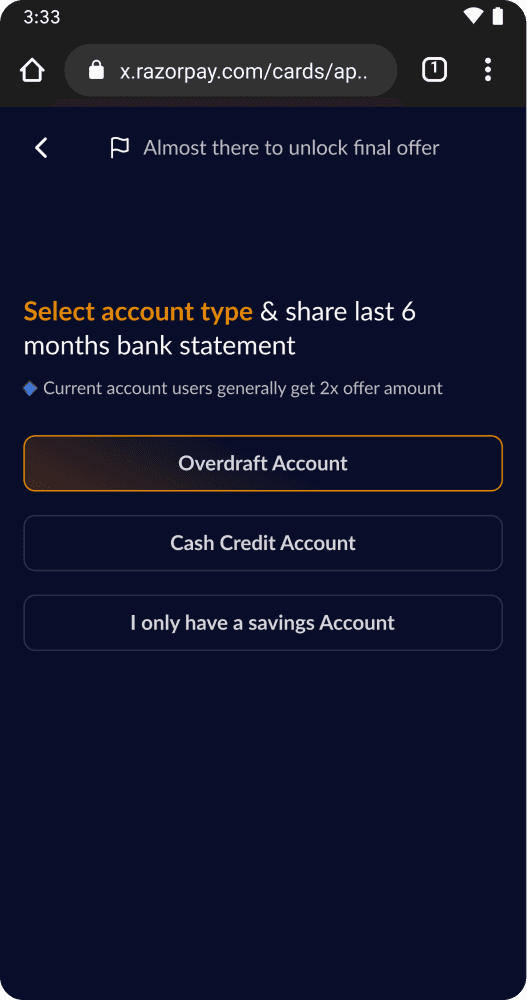

1.1 Account & method selection

Before

After

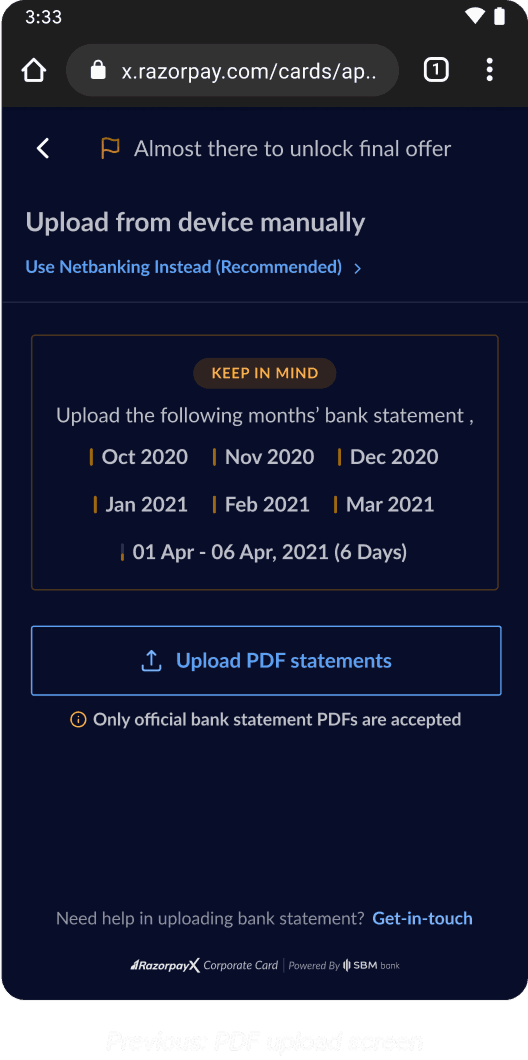

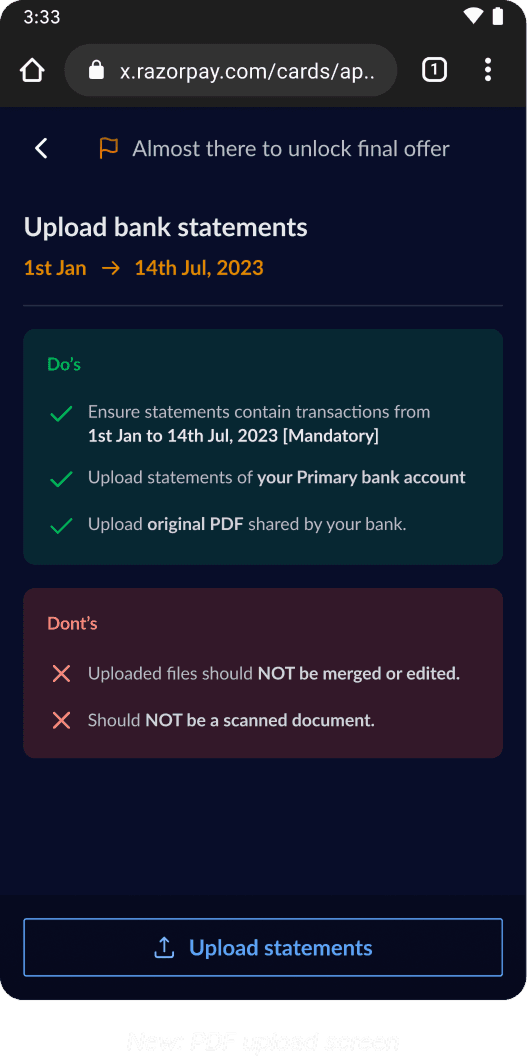

1.2 PDF Upload screens

Before

After

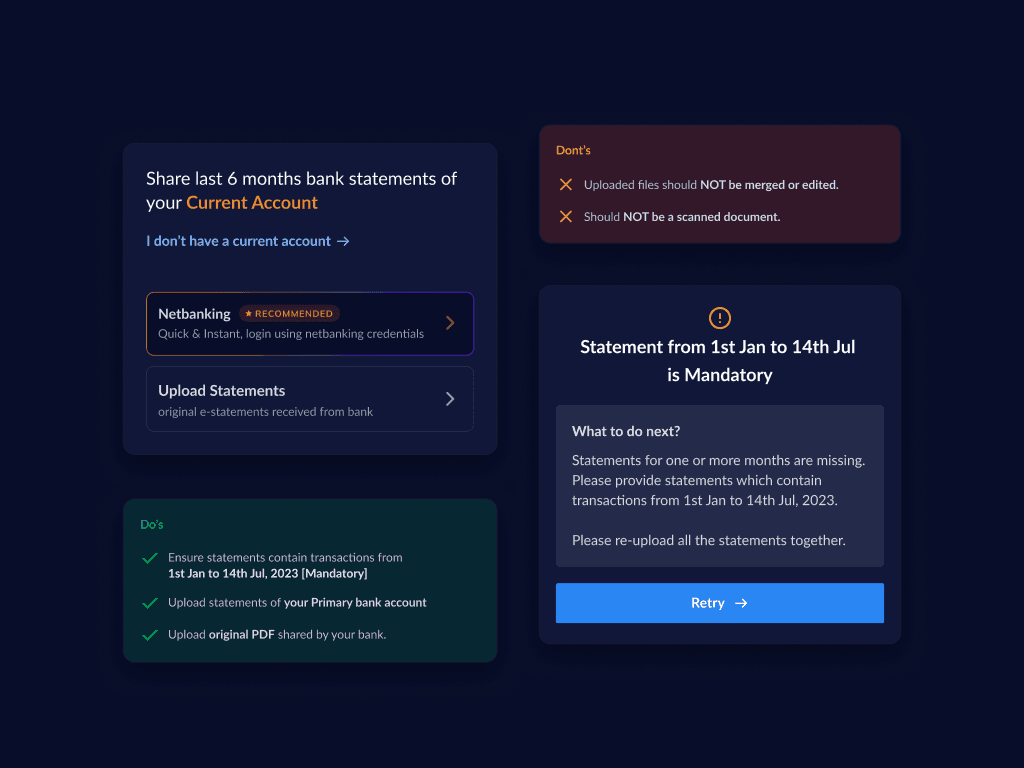

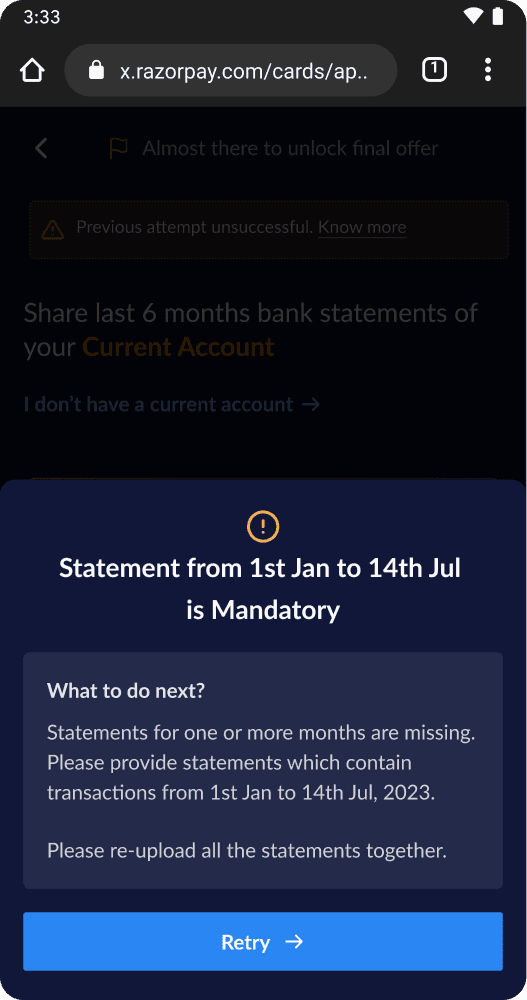

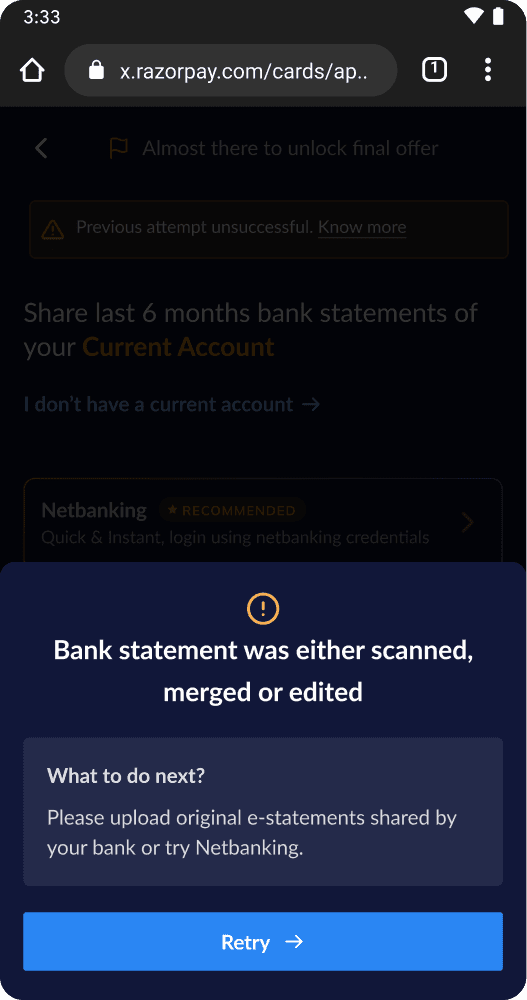

#2 Providing feedback in realtime

This is where our back-end does the heavy lifting to process the bank statements in realtime and ensure the rule engine is able to churn out an offer for the user within 30 seconds (given all requirements are met)

Real time feedback - missing dates

Real time feedback - duplicate file

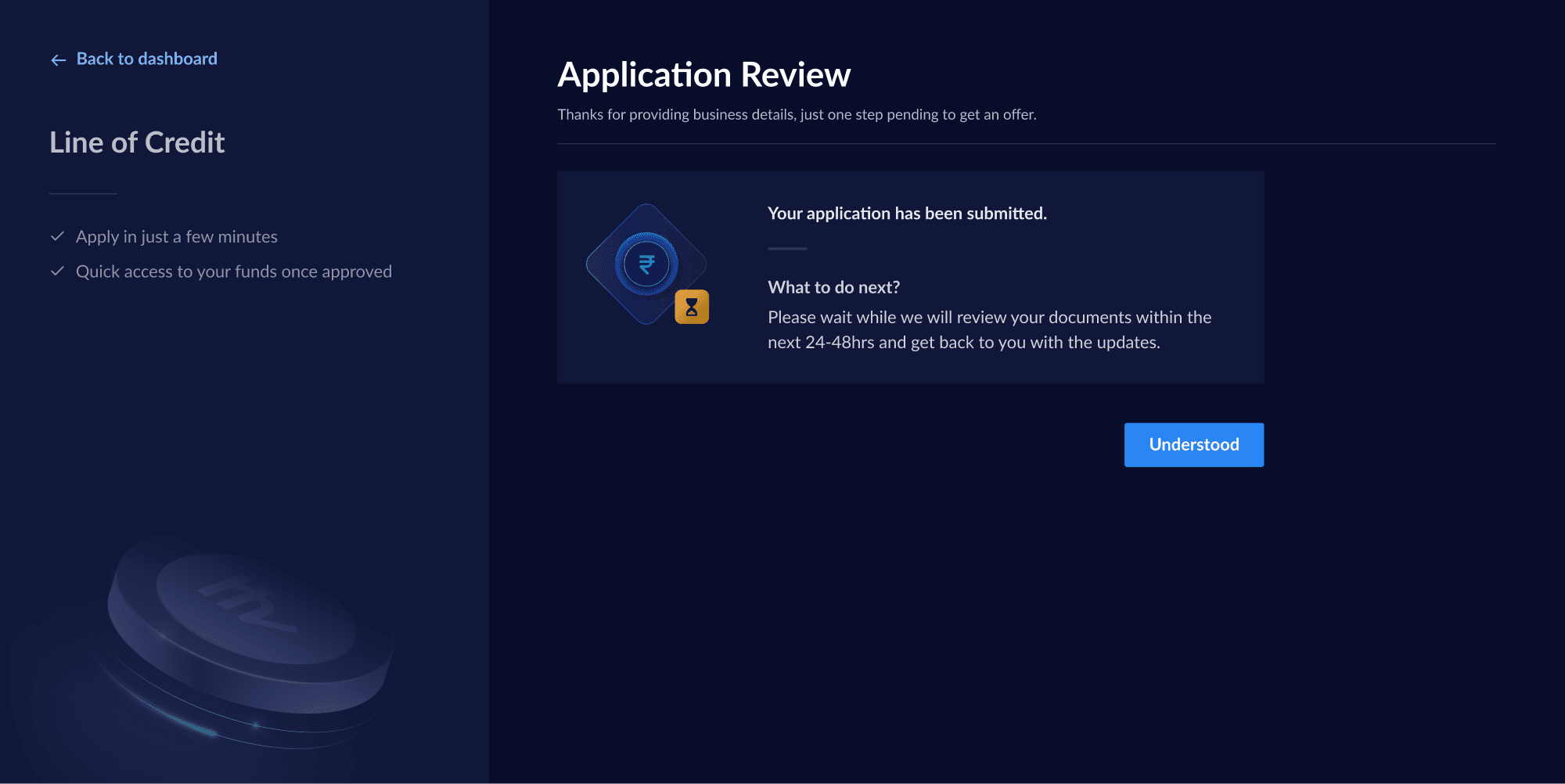

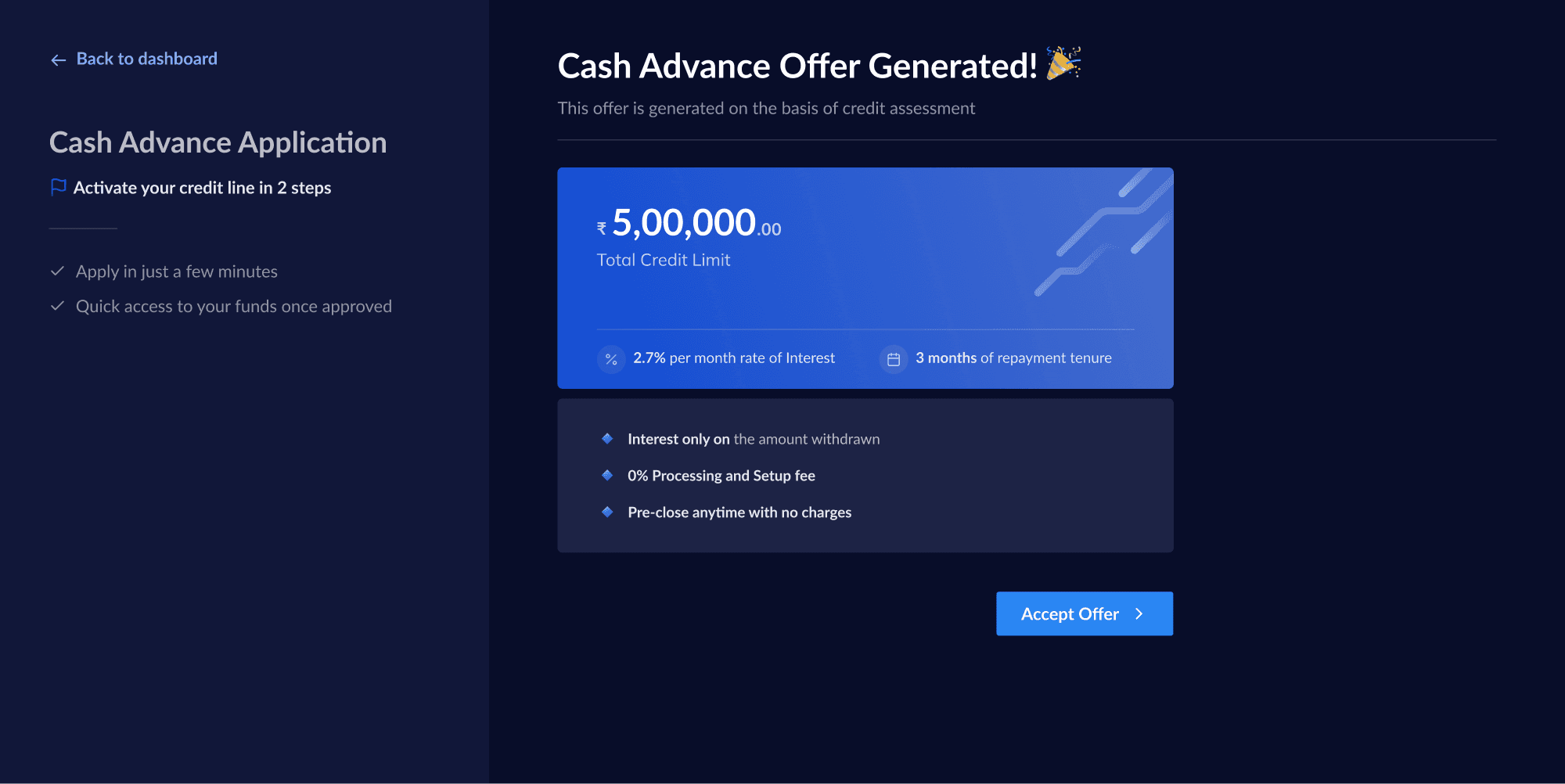

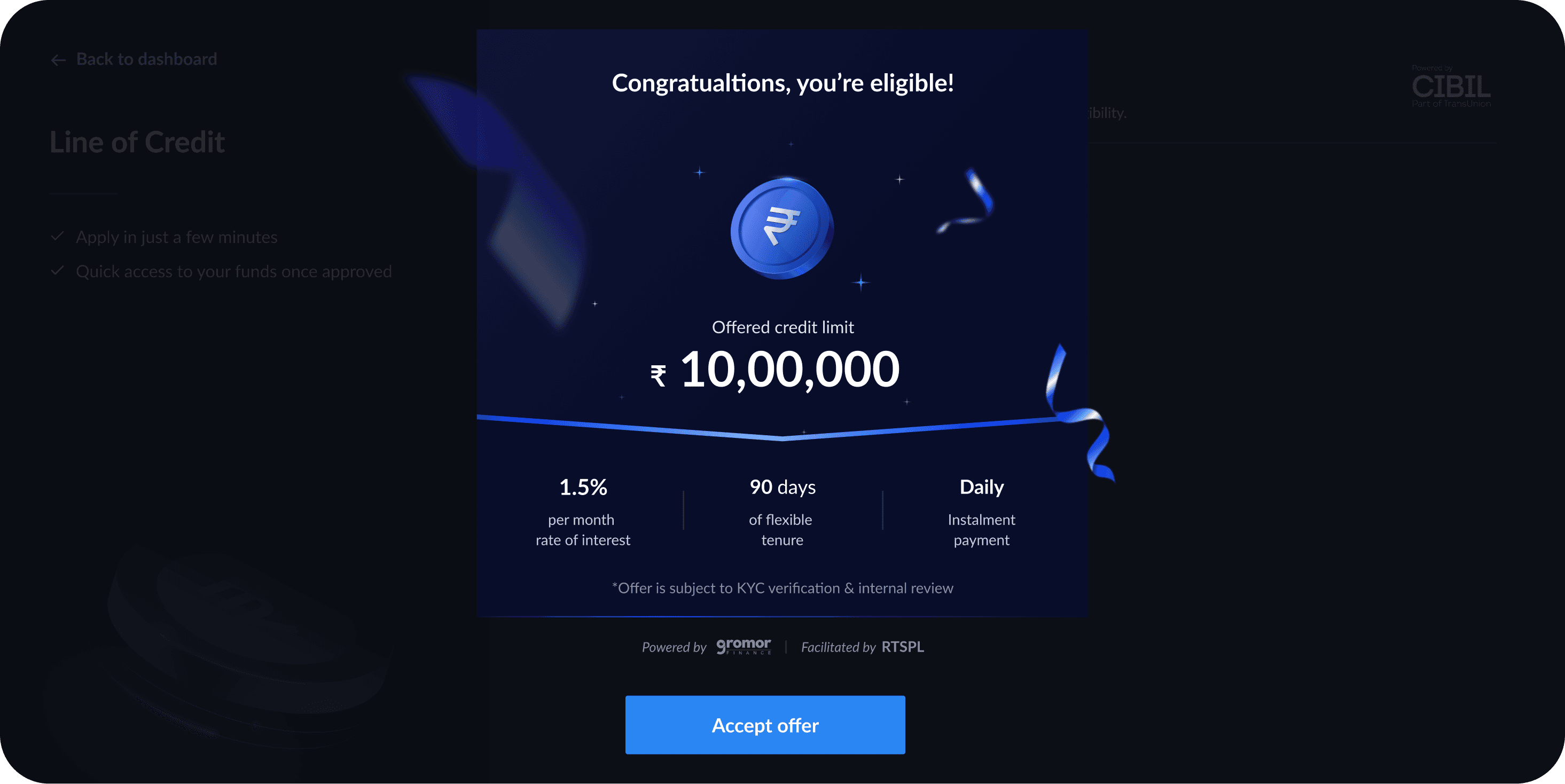

#3 Redesigning the offer screen

~70% of the users drop-off by the offer step. In-order to be truly self serve & increase ops and sales efficiency, the onboarding journey had to be simple & delightful.

The goals for this redesign were to ensure

Offer details are upfront & easy to consume

Looks dynamic & gives a celebratory feeling

Doesn’t distract the user from the task at hand

Before

After - Desktop

After - Mobile